South Africans all across the nation are hopeful that February 2018 marked the dawn of a new era, with the prospects of better working relationships between business and government, dedicated investment in the education and training of our young people and a renewed focus on developing entrepreneurs to grow our economy coupled with an intense clamp down on corruption. MetCon is totally committed to playing its part in this process.

One of the ways Metcon intends to do so is through a deepening relationship with Anglo American Platinum. This relationship has existed since the year 2000 through the two companies’ partnership in the incredibly successful PlatAfrica jewellery competition. Both MetCon and Anglo American Platinum share a passion for platinum jewellery and a desire to support local beneficiation of the metal. Through their partnership, young jewellers, professional jewellers and designers have access to affordable metal which offers them the opportunity to develop and grow their talent with the ultimate objective being to expand the platinum footprint both in the jewellery industry and as investment bars, within South Africa and world-wide.

The history and development of platinum

Although an alloy of the platinum group metals was used in the hieroglyphics which decorated the Casket of Thebes, which dates back to 700 BC, platinum was only properly recognised in the sixteenth century when it was described by an Italian scientist, Julius Scaliger, as “an unknown noble metal which no fire had been able to liquefy”. A Spanish naval officer, Antonio de Ulloa, was first credited with discovering platinum. He had travelled through South America in the 1730s and took note of a metal that looked like silver but did not tarnish. In fact, the local miners in Central America considered it a nuisance as it got in the way while they were mining for gold nuggets. De Ulloa took samples back to Europe and, by 1774, platinum had been established as an element.

Today, we know platinum as a precious transition metal that has the chemical symbol Pt and an atomic number of 78 on the periodic table. Platinum is greyish white in colour and could be mistaken for silver. In fact, the word platinum is derived from the diminutive of the Spanish word for silver – plata – and could therefore be translated as “small silver.” Quite ironically, the price of platinum in recent times has always been a significant multiple of the price of silver! (Silver was trading at around USD 20 an ounce ten years ago and is currently trading between USD 16 and USD 17 an ounce. Platinum was trading at about USD 2,000 an ounce ten years ago and is currently trading at about USD 1,000 an ounce.)

Platinum occurs naturally in Africa, predominantly in the Bushveld Complex of South Africa and the Great Dyke of Zimbabwe, in the Ural Mountains of Russia, in the Sudbury basin of Canada, the Western United States and in Columbia. It is often found in the presence of other metals from the platinum metals group such as palladium, ruthenium, rhodium, iridium and osmium. It can also be found near gold, silver, nickel and copper deposits.

Today, platinum is considered to be one of the rarest precious metals, and the annual world production is about 8 million ounces – about 10 percent of the world’s annual gold production.

Why invest in platinum

Supply and demand

Investment decisions are often driven by pricing considerations and an evaluation of the supply and demand of the asset. With regards to the supply of platinum : the bulk of the metal is to be found in South Africa and Russia – neither of which is generally considered to be a particularly stable or reliable supply territory. Although a few new platinum mining projects are under development, there is no doubt that the metal is extremely rare and in limited supply. The recovery process is also capital and energy intensive so there are significant barriers to entry for junior miners. On the other hand, the demand for the metal is expected to grow as more and more industrial and medical applications are developed. Its main use (around 40%) is as an automotive catalytic converter to reduce toxic emissions from engines, in particular, diesel engines. As environmental controls become stricter, the demand for this application is likely to increase – despite the expected replacement of combustion engines with electrically powered engines. Platinum is also used as a catalyst in the manufacture of nitric acid – the building block of modern day fertilisers – and as a component of catalysts used in oil refining. It is replacing copper in spark plugs because it is more durable and it is used for tools to handle fibre glass due to its very high melting point. It is also used for medical implants because of its extremely low reactivity and it is being used in chemotherapy treatment.

The application for platinum which inspires MetCon and Anglo American Platinum is, of course, its use in jewellery. Platinum engagement rings, wedding bands, necklaces and bracelets account for over a third of the metal’s use each year. There are several reasons for its popularity : it is denser than gold and more hard wearing and is considered to retain its sheen and lustre longer than gold. On the downside, because of its hardness and high melting point (1,758°C versus gold at 1,064°C), it is significantly more expensive to work with. So, despite the plummeting platinum metal prices, the prices of finished platinum jewellery have not changed as materially. This significantly dampened appetite for platinum jewellery in particular in China where savvy consumers expected to see correspondingly lower prices.

Platinum prices

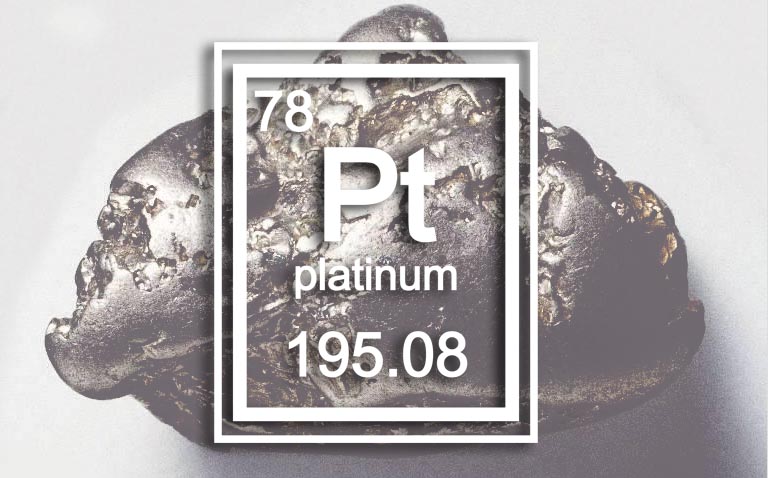

This brings us to the consideration of future pricing for the refined metal. Historically, platinum has traded at the same or significantly higher prices than gold. In fact, in the past ten years it has traded up to almost 2.5 times the price of gold in USD terms. This is reflected in common parlance where a platinum album for a recording artist is considered to be a greater achievement than a gold album and a platinum credit card offers more benefits than a gold one. And yet, from 2015, the price of platinum has consistently been well below the price of gold, to as low as 70% of the gold price in USD terms. This is illustrated in the following graph.

South Africans all across the nation are hopeful that February 2018 marked the dawn of a new era, with the prospects of better working relationships between business and government, dedicated investment in the education and training of our young people and a renewed focus on developing entrepreneurs to grow our economy coupled with an intense clamp down on corruption. MetCon is totally committed to playing its part in this process.

One of the ways Metcon intends to do so is through a deepening relationship with Anglo American Platinum. This relationship has existed since the year 2000 through the two companies’ partnership in the incredibly successful PlatAfrica jewellery competition. Both MetCon and Anglo American Platinum share a passion for platinum jewellery and a desire to support local beneficiation of the metal. Through their partnership, young jewellers, professional jewellers and designers have access to affordable metal which offers them the opportunity to develop and grow their talent with the ultimate objective being to expand the platinum footprint both in the jewellery industry and as investment bars, within South Africa and world-wide.

The history and development of platinum

Although an alloy of the platinum group metals was used in the hieroglyphics which decorated the Casket of Thebes, which dates back to 700 BC, platinum was only properly recognised in the sixteenth century when it was described by an Italian scientist, Julius Scaliger, as “an unknown noble metal which no fire had been able to liquefy”. A Spanish naval officer, Antonio de Ulloa, was first credited with discovering platinum. He had travelled through South America in the 1730s and took note of a metal that looked like silver but did not tarnish. In fact, the local miners in Central America considered it a nuisance as it got in the way while they were mining for gold nuggets. De Ulloa took samples back to Europe and, by 1774, platinum had been established as an element.

Today, we know platinum as a precious transition metal that has the chemical symbol Pt and an atomic number of 78 on the periodic table. Platinum is greyish white in colour and could be mistaken for silver. In fact, the word platinum is derived from the diminutive of the Spanish word for silver – plata – and could therefore be translated as “small silver.” Quite ironically, the price of platinum in recent times has always been a significant multiple of the price of silver! (Silver was trading at around USD 20 an ounce ten years ago and is currently trading between USD 16 and USD 17 an ounce. Platinum was trading at about USD 2,000 an ounce ten years ago and is currently trading at about USD 1,000 an ounce.)

Platinum occurs naturally in Africa, predominantly in the Bushveld Complex of South Africa and the Great Dyke of Zimbabwe, in the Ural Mountains of Russia, in the Sudbury basin of Canada, the Western United States and in Columbia. It is often found in the presence of other metals from the platinum metals group such as palladium, ruthenium, rhodium, iridium and osmium. It can also be found near gold, silver, nickel and copper deposits.

Today, platinum is considered to be one of the rarest precious metals, and the annual world production is about 8 million ounces – about 10 percent of the world’s annual gold production.

Why invest in platinum

Supply and demand

Investment decisions are often driven by pricing considerations and an evaluation of the supply and demand of the asset. With regards to the supply of platinum : the bulk of the metal is to be found in South Africa and Russia – neither of which is generally considered to be a particularly stable or reliable supply territory. Although a few new platinum mining projects are under development, there is no doubt that the metal is extremely rare and in limited supply. The recovery process is also capital and energy intensive so there are significant barriers to entry for junior miners. On the other hand, the demand for the metal is expected to grow as more and more industrial and medical applications are developed. Its main use (around 40%) is as an automotive catalytic converter to reduce toxic emissions from engines, in particular, diesel engines. As environmental controls become stricter, the demand for this application is likely to increase – despite the expected replacement of combustion engines with electrically powered engines. Platinum is also used as a catalyst in the manufacture of nitric acid – the building block of modern day fertilisers – and as a component of catalysts used in oil refining. It is replacing copper in spark plugs because it is more durable and it is used for tools to handle fibre glass due to its very high melting point. It is also used for medical implants because of its extremely low reactivity and it is being used in chemotherapy treatment.

The application for platinum which inspires MetCon and Anglo American Platinum is, of course, its use in jewellery. Platinum engagement rings, wedding bands, necklaces and bracelets account for over a third of the metal’s use each year. There are several reasons for its popularity : it is denser than gold and more hard wearing and is considered to retain its sheen and lustre longer than gold. On the downside, because of its hardness and high melting point (1,758°C versus gold at 1,064°C), it is significantly more expensive to work with. So, despite the plummeting platinum metal prices, the prices of finished platinum jewellery have not changed as materially. This significantly dampened appetite for platinum jewellery in particular in China where savvy consumers expected to see correspondingly lower prices.

Platinum prices

This brings us to the consideration of future pricing for the refined metal. Historically, platinum has traded at the same or significantly higher prices than gold. In fact, in the past ten years it has traded up to almost 2.5 times the price of gold in USD terms. This is reflected in common parlance where a platinum album for a recording artist is considered to be a greater achievement than a gold album and a platinum credit card offers more benefits than a gold one. And yet, from 2015, the price of platinum has consistently been well below the price of gold, to as low as 70% of the gold price in USD terms. This is illustrated in the following graph.

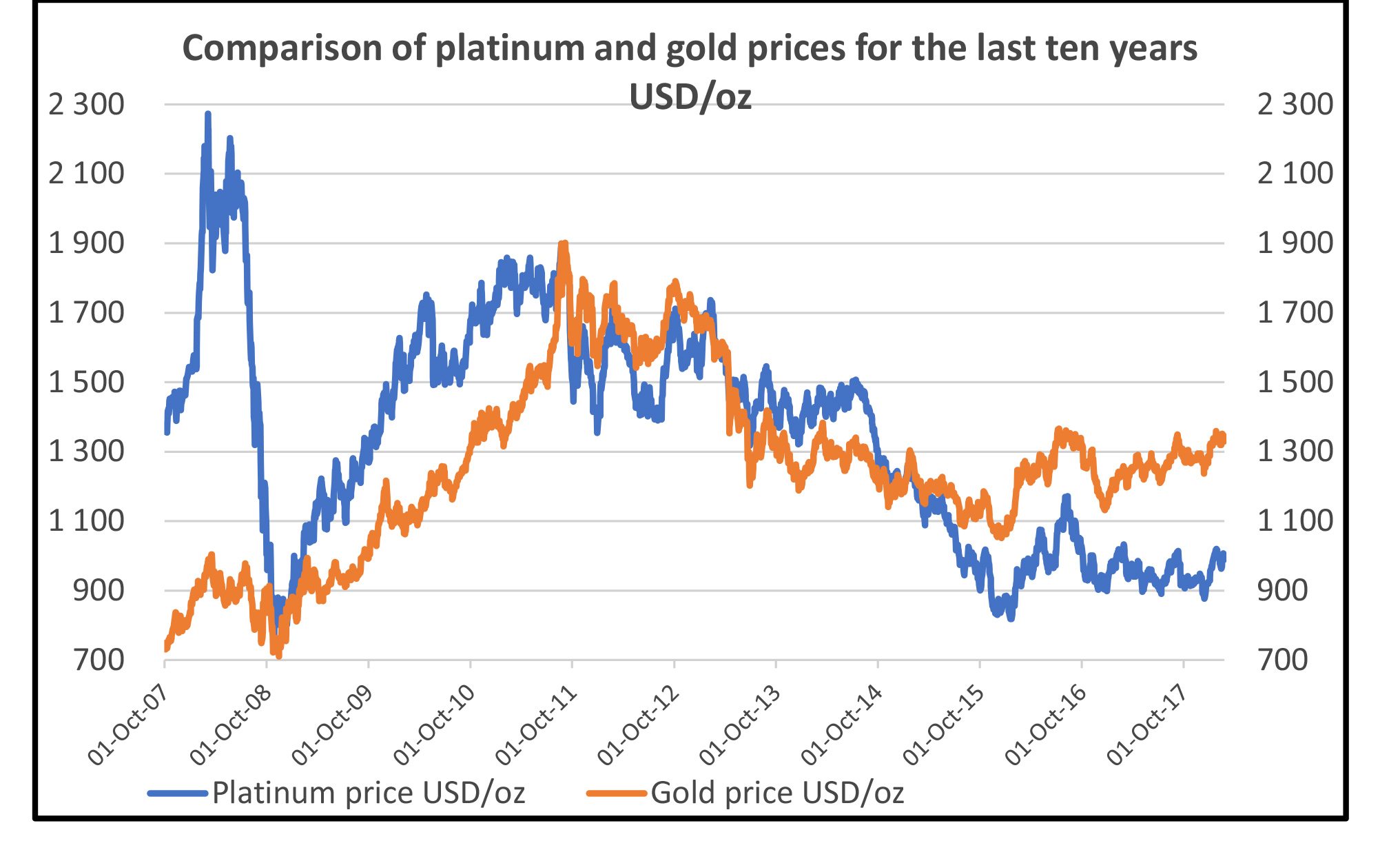

The trigger for the selloff of platinum in 2014 was most likely linked to faltering industrial growth in China and elsewhere and rising levels of supply of general commodities in key markets. As discussed earlier, a major portion of the demand for platinum comes from industrial applications, particularly in catalytic converters for automotive engines. When global industrial activity slows down, the demand for platinum correspondingly declines. Together with the collapse in the oil price and other commodity prices, the price of platinum therefore also fell. Platinum took a further blow in 2015 when Volkswagen was caught out in the emissions testing scandal for its diesel engines. Consumer confidence in diesel automotives was seriously damaged and the price of platinum was hammered by the expectation of a significant decline in future demand for diesel driven motor vehicles. These shocks to the pricing of the metal are set out in the following graph.

The future

Possibly a somewhat contrarian view, but the price of platinum could well be set on a positive upwards path given:

- the pick up in the global economy which should boost both industrial consumption of the metal as well as the demand for jewellery;

- the development of hydrogen fuel cell technology;

- the expectation that the recent change in government leadership in South Africa will lead to greater stability and confidence in the South African mining industry, settling the minds of both local and international investors that the supply of platinum is, at the very least, more predictable; and

- the ongoing development of more industrial and medical applications for the metal.

Investors have fairly limited choices to secure their exposure to any potential upside in the platinum price. It is of course possible to buy shares in platinum mining houses such as Anglo American Platinum. There are also a few Exchange Traded Funds (ETFs) and Exchange Traded Notes (ETNs) with a focus on platinum (for example the New Plat ETF and the NewWave Platinum ETN offered by ABSA). None of these, however, offer the thrill and pleasure of owning the metal outright.

The potential value of platinum bars such as those produced by MetCon has perhaps therefore never been greater. Not only do they offer direct exposure to the platinum metal price, but they are exquisitely beautiful works of art. It is indeed time to carefully consider the investment appeal of this uniquely crafted, wholly South African product that encompasses and reflects the beauty and creativity of our land and its people.

-Written by Morag McGarvie for MetCon